Layoffs don't seem to stop, Why?

You'd imagine that after a horrifying first half, 2022 will largely be calm. And here we are, yet again in the eye of another lay-off storm. Why haven't the lay-offs stopped already?

As kismet would have it, I’ve been part of 3 lay-offs so far in a short span of 2 years.

My previous company laid off almost half of its employees in December 2020, then shut down completely in July 2022 & now Carousell laid off 10% of its staff.

Before you read further - a humble appeal 🙏

Are you looking for passionate & smart folks to join your team? Consider reaching out to my former colleagues who were unfortunately impacted in the recent re-org at Carousell. You can find the full list here.

DM me directly if there's a specific skill set you're looking to hire immediately & need a recommendation (especially in engineering, data, design & product).

While writing my previous article on What’s up with Startups, I blamed the lay-offs squarely on macroeconomic factors. Companies were merely responding to external stimuli & making course corrections.

As the year rolls on & more companies join the infamous leaderboard, we are forced to ask the tough questions. Are we learning from our mistakes?

Learning from previous lay-offs

All companies which aren’t profitable yet would most likely have gathered a few key takeaways from the layoffs in the first half of the year -

Recovery is an over-optimistic stance: A few too many tech companies have learned the hard way that we are nowhere close to recovering from this downturn. It isn’t a “crash” like 2008, but a slow downward trend that might take at least a few more years to reveal its lowest point and further few more to show signs of recovery.

Investor funds have dried up: It’s a solid bear market right now & there’s no way one can raise a decent round of funds under such circumstances. Look at -

Lowering burns rate: Cut unnecessary costs, and find all means to reduce operating costs. For tech companies, a significantly high percentage (~10-15%) of operating costs go towards 3rd party non-critical software like Slack, Zoom, Confluence, etc, which can be easily replaced by their cheaper counterparts like Zoho Cliq, Google Meet, Google Docs, with minor inconveniences. Smaller office spaces, and cutting extravagant employee benefits - all of this helps.

Shoring up finances: Most venture-backed companies’ financial reports (and hence all the tracking down the line) are built to raise funds. This means the numbers are presented in a manner to highlight higher revenues & lower expenses. Revenue for services/products to be delivered next year is booked today & costs like rent, and utilities are hidden away as "miscellaneous”. Running this system long enough even blinds the internal management to the real cost of running their business & the actual revenue it generates. Cleaning this system up is painful, but necessary to prepare for the long winter.

Investing in revenue generation: Even though long-term vision is essential for companies, ensuring the gross profits keep climbing steadily should be the driving factor for most high-level decisions in this climate. If a company has 3 years of runway left, it should only invest in projects that will break even within a year. Anything beyond that is a pipe dream.

Hire with care: Most tech companies are already overstaffed. Hiring for additional staff should be discouraged if not completely put off. Promote star performers aggressively to fill up managerial positions (rather than hire someone with 10-15 years of experience). Train others to internally move employees into BUs that need more hands on deck.

Repeating mistakes

Just last month in November’22, companies like Google, Meta, Twitter & Amazon announced their plans to lay off thousands of employees they had “overhired” during the pandemic. Companies are shaping their narrative in different ways, saying they’re only letting go of poor performers or coasters or they want to achieve better cash flows, etc. Surprisingly all the above companies are profitable (except Twitter), so their cash flow is a net positive. Yet they are panicking as they see their rising costs graph meeting their slowing revenues graph well into the future. This has spooked cash-guzzling mini giants like Grab & GoTo.

The unfortunate part of this episode is that none of the other companies came to their senses soon after the series of lay-offs in the first half (H1) of the year. Most continued to make critical mistakes -

Optimistic revenue projections: Optimistic H2 financial projections were made assuming a fast recovery. These were primarily based on “market analysis”, which is available in both optimistic & pessimistic flavors depending on which one you (or your investor) want to consume (much like any other content).

Increased investments into long-term growth: Over-optimistic projections tend to hide short-term pitfalls & forces the management to look “excessively” long term (beyond the available runway). This tends to take away resources from “cash cow” business units (BU), which are told to tighten up their belts and deliver marginal growth at significantly reduced costs. Instead, excess funds are invested into “Star” projects that might generate high impact down the line with little to no accountability today.

First mover mentality: In a bull market, management is expected to discover new opportunities before the competition does. Acquisitions, exploring new markets, and launching new BUs - are all part of this framework. In a bear market though, these very same moves are death traps. They sharply increase operating costs and rarely generate revenues immediately whilst distracting the management from their core business to a shiny new toy.

Hire away: All the shiny new toys need people to run them - so the obvious next misstep is a hiring frenzy. This is also why the tech job market never cooled down even after a massive layoff. Companies saw their competitors laying off as a sign of their weakness rather than the market not being right & unwittingly pressing on with their future investments in hopes of gulping a larger market share.

This puts the company in a precarious position once the realization hits that market isn’t responding the way it hoped for. And most likely the financial projections have overestimated growth in revenues.

Do layoffs work?

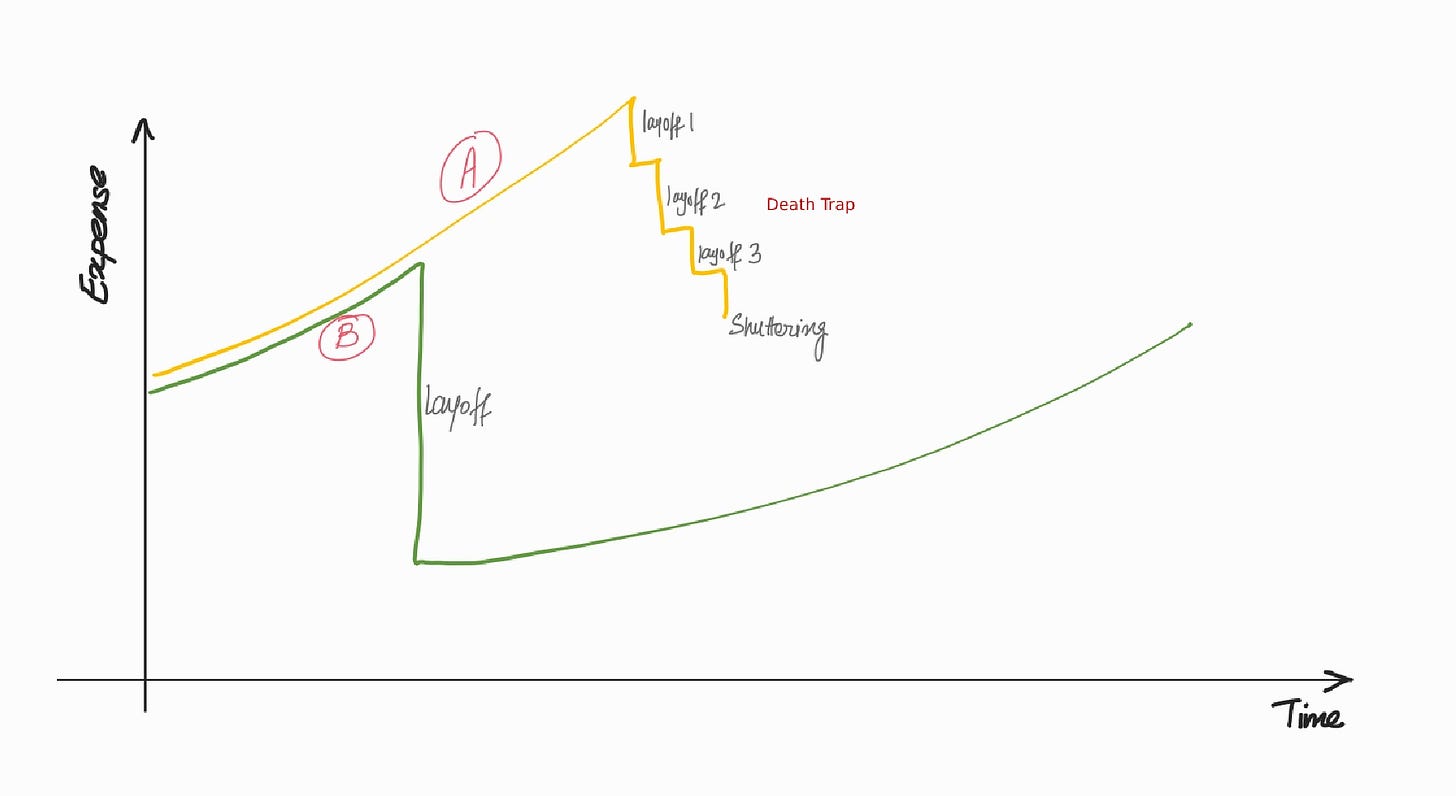

Layoffs are sometimes unavoidable & if not done at the right time could lead to an even worse situation for the company. Here’s a graph that represents two situations -

Situation A is where a company delays layoffs to the point they are forced to start cutting costs. As this is a rather unplanned cut, it results in a direct revenue & productivity impact, leading to even more cuts, layoffs, and eventually shuttering. It’s a death tap.

Compare that to situation B, where a company predicts a precarious situation in the future and makes a major correction while it has sufficient funds. And since it’s a planned move, the impact on revenue is accounted for - a much better situation to be in.

In this light, let us look at the expected upsides of a lay-off

Lower salary costs: Salaries are arguably the largest chunk of operating expenses for an internet company. Any major reduction (>10%) in the workforce immediately shows up on the balance sheet as boosted EBITA. This also immediately shows up in an increased run-way for the company.

Increased productivity: In the short term, a reduced workforce has to achieve the same levels of revenues, leading to higher net productivity.

Better financial projections: Improved EBITA today usually translates to faster break-evens/ profitability in the future. As investor funds dry up, managements are keen to achieve profitability fast & cutting headcount seems to be the strategic “correction” that seems to help (at least on the financial models).

Instant strategic focus/shift: Most layoffs are followed by a company-wide strategic shift and reprioritization. In usual circumstances, it takes months of effort to bring about a shift in direction. Layoffs are almost like an earthquake leading to a tectonic shift in a company’s direction & focus within a small period.

Despite these upsides, most lay-offs don’t yield the desired results, Why?

According to an article published in Harvard Business Review by Sandra J. Sucher and Shalene Gupta, bad lay-offs and/or layoffs for wrong reasons often leads to medium to long-term damage to a company.

They define bad lay-off as one that is ill-managed, perceived as unfair which can have massive negative knock on effect. Whereas, layoffs done for short-term gains rather than long term strategic shift are defined as lay-off for wrong reasons.

The article then goes on to highlight the downsides of a layoff which are either bad or for the wrong reasons or even worse - both

Increased attrition & negative impact on employees: For every 1% of the workforce laid off, voluntary turnover increases by 31% in the following year. This is primarily due to decreased morale among employees, who generally feel they no longer have control over their livelihoods despite good performance.

Reduced performance: After a traumatic lay-off most of the remaining employees experience ~20% reduction in performance in the medium to long term due to burn-outs & general lack of commitment towards the company.

Customer defect: Post a messy layoff, the overall reputation of a company declines considerably, leading to customers defecting to alternatives. Rupture in relationships between salespersons & customers after a lay-off also plays a significant role.

Decline in profits: Most companies that lay off their employees improperly saw a decline in their profits that persists over three years & also makes them twice as likely to file for bankruptcy when compared to companies that don’t lay off their staff.

Most companies continue on a downward spiral post-layoff. In most cases, they’re the ones who tend to treat it as a tool for short-term gain - to reach profit targets for the year. The layoff was done for the wrong reasons.

Management might likely find a false sense of security in a financial model which only accounts for the upsides (reduced costs, boosted EBITA) but doesn’t account for knock-on effects (lower productivity, lack of customer trust & declining profits) post-layoff. If not corrected immediately post-layoff, it is highly likely that the company will fall back into the same death trap & will have to lay off again sooner or later.

What about Carousell?

We can look at the recent layoff & re-org done by Carousell through the same lens.

Was it a bad layoff?

Since this wasn’t a performance-based layoff, impacted employees could have felt wronged. And those who stayed back felt a deep sense of guilt as they saw their colleagues being let go ‘randomly’. There was a sincere effort to address these feelings through

Expression of empathy & respect during layoff announcement

Generous severance packages

Extended work visas & health insurance

Accelerated ESOP vesting

Encashment of leaves & benefits

Career & mental support for both impacted & retained employees

It is unrealistic to assume that there won’t be any knock-on effects after this, even though the most drastic ones seem to have been addressed. At this point, it’s safe to say it wasn’t a bad layoff.

Was it a Layoff for the wrong reasons?

The reasons for Carousell’s re-organization as mentioned in the blog were

Over-estimation of growth, leading to increased investment & hires.

A larger team leads to a lack of clarity in decisions

As part of the course correction suggested in the blog, Carousell will “sharpen priorities as a company, keep a watchful eye on costs, and only invest in high conviction initiatives that are properly set up for success.” The hope is that it results in a company-wide rejig of financial plans that account for slow growth and the impact of smaller team size.

This is miles away from using layoffs as a mere profit booster for the year. This gives me confidence that Carousell will likely not fall into the death trap & emerge stronger than before.

Will the layoffs stop soon?

In short - No.

According to various estimates, we’ll likely continue to be in a modest recession for at least the first half of 2023. It would be safe to assume that tech companies would continue to exercise caution and rein in costs till the end of 2023. The first signs of recovery might only be visible in early 2024. An economy not in a recession doesn’t translate to all sectors starting to grow. Tech will likely take longer to attract fresh funds.

This means companies will continue to rightsize throughout this period. Those who’ve recently raised funds and overhired or overestimated their growth will need to trim the fat before they fall into the death trap.

P.S.: I’m not a VC or finance expert. Most of the information here is composed of pieces gathered from VCs, founders, board members, and news sources. All contents of this article are my personal opinion. Always open to suggestions. 🙏