What's up with Start-ups?

First the bloodbath at Nasdaq and now a flurry of lay-offs. What's going on?

I’ve been in South East Asia for just over three years. I’ve increasingly grown more attached to the start-up & tech community here. So when the news of Grab exploring an IPO started to make rounds, I was really excited. There are a few big fishes in the SEA (pun intended) and Grab is definitely one of them. I even made a half hearted attempt at reading their SPAC report a day before the bell went-off at Nasdaq.

While most of us were hoping for some market corrections to happen, none of us were ready to see Grab loose 75% of its initial valuation over the span of 3 to 4 months (December 2021 to March 2022).

The nightmare repeated itself when PropertyGuru, another heavy-weight in the start-up world, went public on 18th March 2022, and right away lost $270 million in market capitalisation!

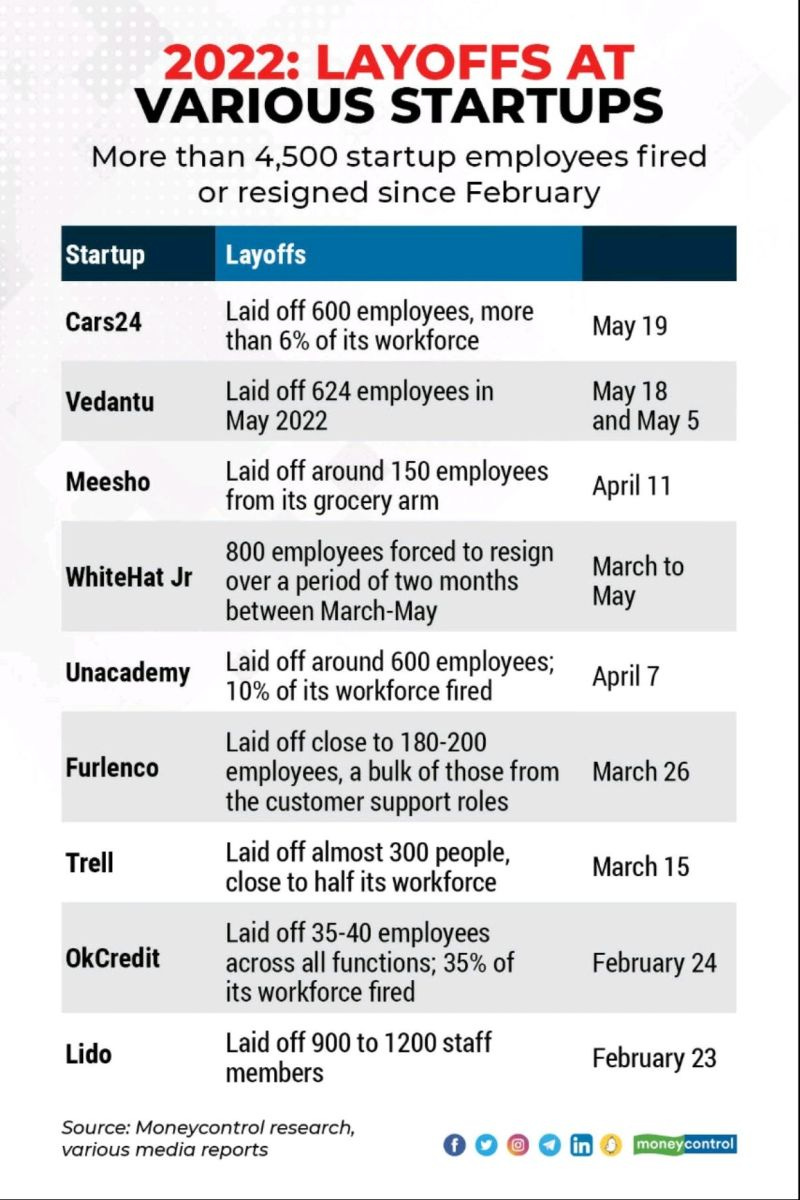

And few weeks ago- ominous news have started to pour in from India as unicorns & rocket-ships 🚀 started shedding employees and valuations.

So, where do we begin? Covid-19?

Let’s start with Covid-19. It’s an ongoing pandemic or endemic depending on which country you reside in.

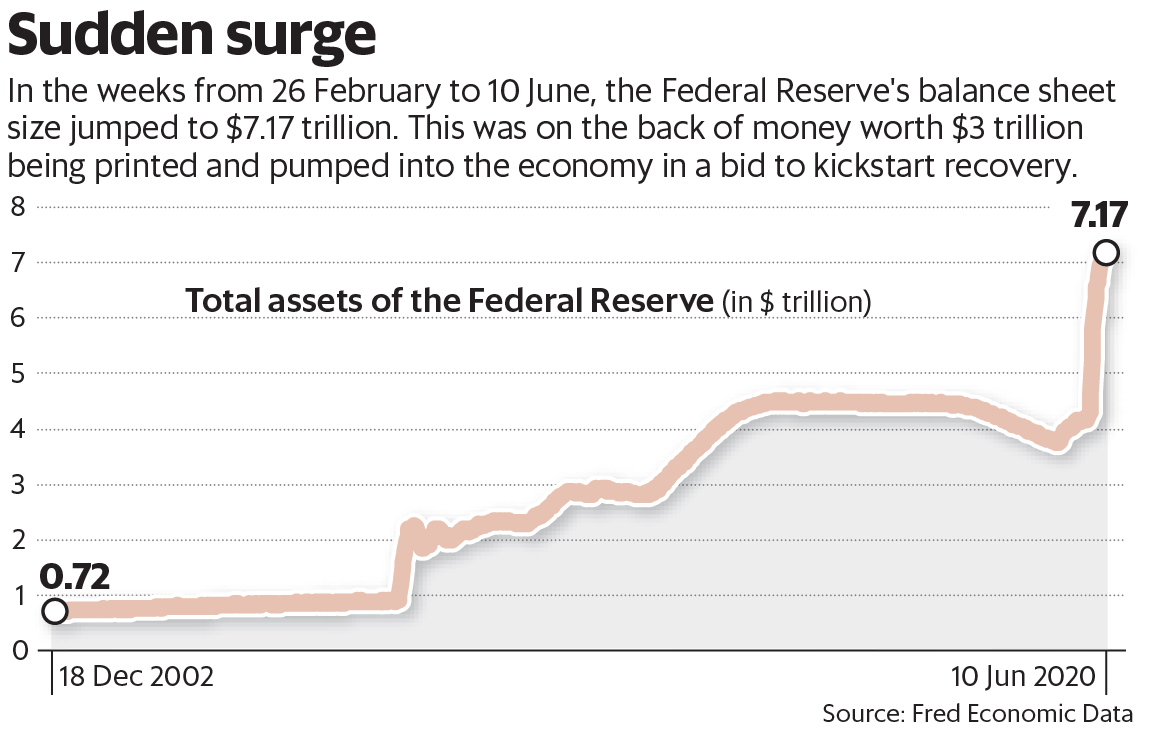

Most governments pulled all plugs to ensure their citizens could coast over the tough times ahead by giving unemployment packages & cheaper interest rates on loans. And if you don’t already know, most governments don’t hold that kind of reservers to feed all its citizens without a certain level of production to match it. So what did they do? Print money (without collateral). Now, this has a knock-on effect when you print more money & distribute it among your people without having them to produce anything - INFLATION.

Basically if everyone suddenly has $100 more in their pockets - demand rises without the supply , hence everything becomes costlier, thus inflation. This is what US did when they printed $3 Trillion over just 3 months in 2020. Most of it was pumped into the financial institutions (through purchase of bonds) which increased the money available to be borrowed.

In its early days, inflations always go rather undetected. This is a period of near zero interest rates from central banks and plenty of ‘free’ cash to go around. 2020-2021 was remarkable period for VCs and tech start-ups.

And this is where most start-ups charted their course for ‘growth at all costs’. Most founders, tempted by the pile of cash, brushed aside the apprehensions of Covid-19 and a looming slowdown.

Anecdotally, I remember speaking to VC advisor about a recent news of Bukuwarung raising $60M in 2021 on back of growing user base, with little to show for revenue/monetisation model.

Oh sh*t! We got to control the inflations!

The inflation was then further egged on by energy crisis arising out of Russia Ukraine war. US saw a 22 year high inflation rate in March 2022 of 8.5%. This was immediately followed by increasing the the interest rates by the Central Bank from 0.75% to 1% (doesn’t seem much of a change, does it?), with the higher costs passed down to consumers in the form of expensive mortgages, credit cards and other loans.

How does that affect VC funding you ask? Well - a lot. You see, investors of a VC (yes VCs also have their own investors) are mostly financial institutions and individual investors. In most cases, the money they invest come from bank loans. No one puts their savings in to VC funds. So as the loans get expensive, the VC’s appetite for risk goes down. According to an estimate, each percent increase in interest rates depletes about $647M of VC funds available to start-ups.

A market correction

VCs carefully choose which of their lambs to sacrifice at the alter of the stock market. They look forward to IPOs of their unicorns as a way for them to make substantial gains on their investment to secure next pot of gold for future funding.

This was the similar feeling when Grab went for its listing on the Nasdaq, valuing itself at $40B. With Grab still posting quarterly losses of ~$988M in 2021, the market wasn’t so bullish about it. Shortly after the listing, Grab slid down 20% and now sits at a total valuation of just below $10B. This sort of a market correction drastically reduces the amount of cash VCs have at hand to spend.

A harsh reality

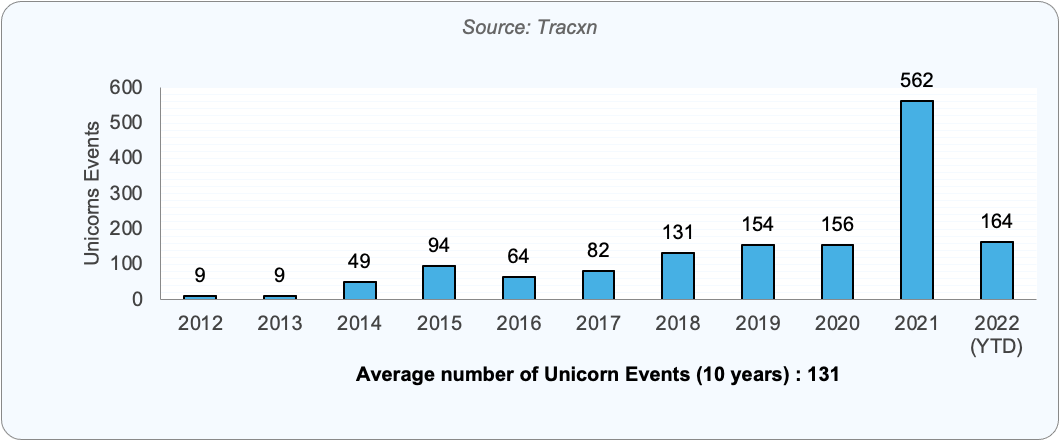

After the bloodbath seen by Grab & PropertyGuru at Nasdaq, even seasoned players like SoftBank & Sequoia went into a panic- advising it’s top executives to slow down on their next investment. As expected, VC funds started to dry up & the prospect of fundraise for most start-ups (especially Series C and beyond) became a distant dream. Look at the rate of Unicorn creation- the sharp increase of 2021 and an equally sharp decline of 2022 (if you consider the run-rate).

For startups & unicorns who were full steam ahead on growth trajectory could see the end of runway fast approaching. And here is where the harsh reality hits. Start-ups, being as nimble as they are, can make a sharp turn from the path of growth to a path of survival & efficiency. But it comes at a cost. Very real human cost. Lay-offs, rescinded offers, shuttering to name a few.

P.S: I’m not a VC or finance expert. Most of the information here is composed of pieces gathered from VCs, founders, board members and news sources. Always open to suggestions. 🙏

Great insights as usual!